VVT Med Receives Order from Major US Healthcare Network NorthWell Health and Enters Into Investor Relations Agreements/

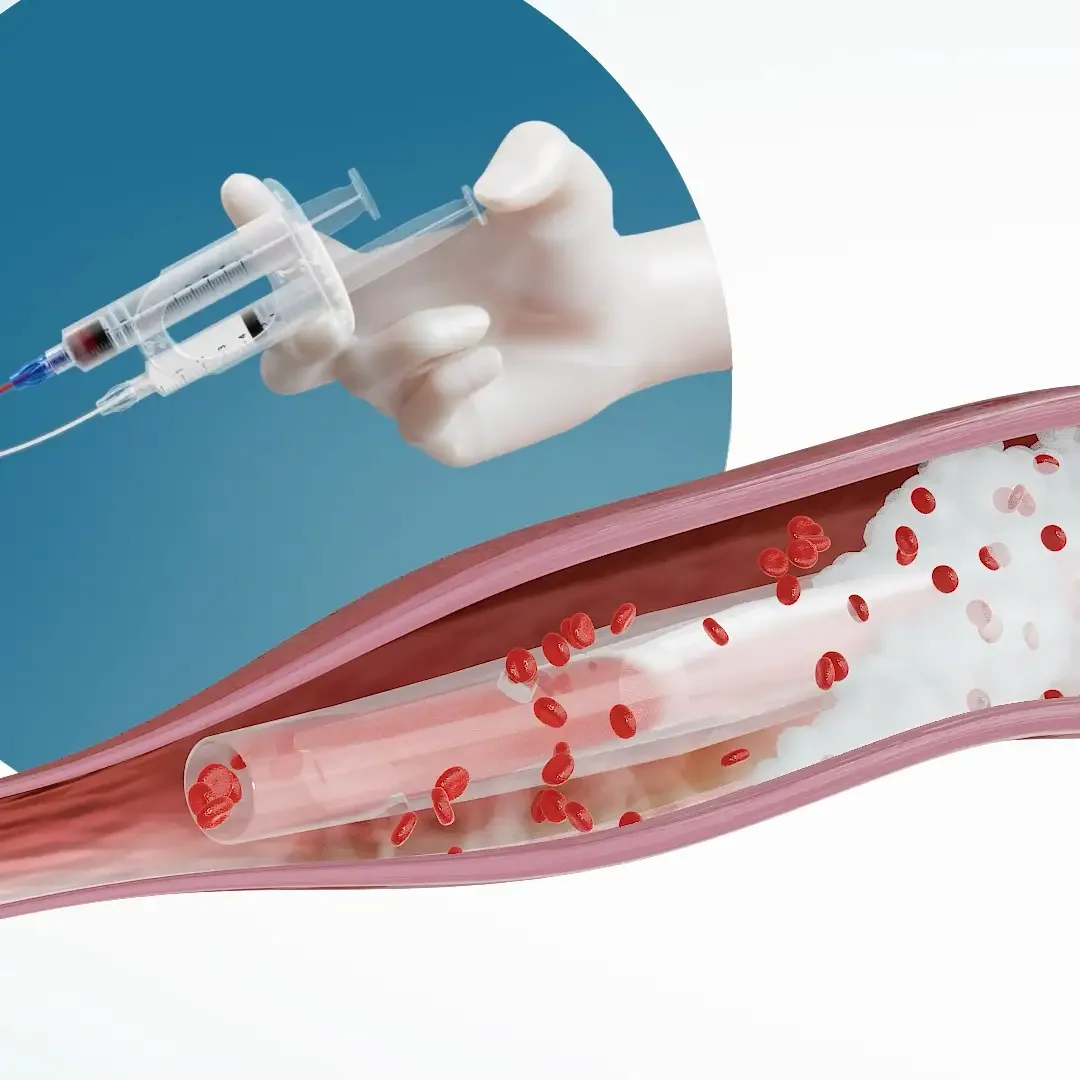

VVT Med Inc. (TSXV: VVTM) (the "Company" or "VVT Med"), a manufacturer of next-generation, minimally-invasive varicose vein treatments, is pleased to announce an initial order for several units of its flagship ScleroSafe™ technology from Northwell Health, one of the largest healthcare providers in the United States. This pivotal achievement validates the product's clinical value and marks a crucial entry into the U.S. public hospital market.

The initial order will be deployed under the direction of Dr. Antonios Gasparis, Professor of Surgery and Director of the Center for Vein Care at Northwell Health. Dr. Gasparis leads one of the largest vein care programs in the United States, where his team provides a wide range of treatments for patients with venous disease. His department's evaluation of ScleroSafe™ is expected to inform potential future use across Northwell's system.

New York-based Northwell Health is one of the USA's largest health care networks, with over 100,000 employees at 28 hospitals and 1,000+ clinics. Northwell also operates one of the nation's leading vein programs. VVT's patented solution will enable Northwell to streamline varicose vein procedures without requiring anesthetics or capital investment.

"Only 2% of symptomatic varicose vein patients undergo treatment, largely due the lack of ideal solutions in the market, awareness, and fear of pain and potential complications involved in current procedures. VVT's ScleroSafe™ enables these treatments to be completed in a more accessible manner, minimizing pain and post procedure care," said Erez Tetro, CEO of VVT.

The Company believes this milestone validates the competitive differentiation of its technology and its ability to meet the standards of a top-tier U.S. health system. It positions VVT for future growth within the U.S. market, serving as a powerful reference for other hospital systems that are currently considering the adoption of the product.

Investor Relations Agreements with I3 and Revolution

On the heels of the VVT's first scaled entry into the United States – the world's largest varicose vein market - the Company plans to introduce its story to investment communities throughout North America. This will be the first such initiative since the company completed its public listing earlier this year.

Accordingly, VVT is pleased to announce that it has entered into an investor relations agreement dated October 28, 2025 (the "i3 Agreement") with I3 Capital Group Ltd. ("I3"), a Toronto-based firm specializing in investor relations and capital markets advisory services.

Under the Agreement, I3 will provide a broad range of services including corporate communications, investor relations, marketing strategy, business development, and related duties. These services are designed to enhance awareness of VVT's business and growth plans among existing and potential investors, as well as the broader financial community.

The initial term of the I3 Agreement is three months, following which the Agreement will automatically renew on a quarterly basis unless terminated with 30 days' written notice.

Subject to the approval of the TSX Venture Exchange (the "Exchange"), the Company will grant I3 400,000 stock options under its equity incentive plan. The options will have a two-year term and will vest in four equal tranches of 100,000 options each, beginning three months after the date of grant and every three months thereafter.

In addition to the options, I3 will receive cash compensation totaling $55,000, payable as follows:

An initial fee of $10,000 plus HST upon signing;

$10,000 plus HST per month for the first three months, payable at the end of the third month;

Subject to renewal, $5,000 plus HST per month for the following three months and no cash fees for the subsequent six months.

The Company and I3 act at arm's length. I3 and its principals currently hold, or have control or direction over, 318,000 common shares of the Company and securities to acquire an additional 57,590 common shares. Aside from these holdings and the stock options described above, I3 has no other present interest, directly or indirectly, in the Company or its securities, nor any right or intent to acquire such an interest, though may elect to do so during and after the engagement.

Revolution Agreement

VVT Med is also pleased to announce that it has entered into an agreement with 1001103323 Ontario Inc. (d.b.a Revolution Small Cap Marketing) ("Revolution") to provide marketing services, including social media engagement through X (formerly Twitter), Facebook, YouTube and Reddit.

The initial term of the Revolution Agreement is 90 days, commencing on Oct 28, 2025, and may be renewed with mutual written consent. During the initial term, Revolution will be paid CAD$40,000 plus applicable taxes. The Company will not issue any securities to Revolution as compensation for its marketing services.

Revolution and VVT Med are not related parties and operate at arm's length. Neither Revolution nor its principals currently own any of the Company's securities directly or indirectly, or have any right or intent to acquire such an interest.

The I3 and Revolution Agreements and the granting of stock options are subject to the approval of the Exchange and shareholder approval of the Company's equity incentive plan. I3 has agreed to comply with all applicable securities laws and the policies of the Exchange in providing services to the Company.

SOURCE VVT Med Inc.

Media Contact: Orly Efraty, Email: orly@vvtmed.com